Car insurance is an essential part of vehicle ownership, providing financial protection in the event of accidents, theft, or damage. However, many consumers wonder exactly what they are paying for when they pay their car insurance fees, also called premiums.

This article explores the components that make up your car insurance fees, the different types of coverages included, factors affecting your costs, optional add-ons, how premiums are calculated, and tips to save money. By understanding the full picture, you can make informed decisions about your coverage and manage your expenses wisely.

Key Takeaways

- Car insurance fees include liability, collision, comprehensive, and optional coverages.

- Your personal factors, vehicle type, and location heavily influence fees.

- Deductibles and coverage limits directly affect premium size.

- Discounts and surcharges play a big role in final cost.

- Premiums are calculated through actuarial risk modeling and underwriting.

- Regularly reviewing your policy and driving habits can help reduce your fees.

- Optional add-ons provide extra security but increase fees.

Understanding Car Insurance Fees

Car insurance fees, or premiums, are payments you make—usually monthly, quarterly, or annually—to keep your insurance policy active. In return, your insurer agrees to cover certain financial losses related to your vehicle under specified conditions.

Your fees are not arbitrary; they are carefully calculated based on the risk you pose as a driver, the extent of coverage you select, and the cost insurers expect to pay in claims.

Core Coverage Types Included in Car Insurance Fees

Car insurance policies are typically composed of several types of coverage that collectively protect you, your vehicle, other drivers, passengers, and sometimes even your property. Understanding what each core coverage entails will help you appreciate what your insurance fees cover and decide which options best suit your needs. Below is a detailed breakdown of the main types of coverage usually included in car insurance policies:

Liability Coverage

Liability coverage is the foundation of most car insurance policies and is mandatory in nearly every state. It protects you financially if you cause an accident that results in injury or property damage to others.

- Bodily Injury Liability

This part of liability insurance pays for medical expenses, lost wages, pain and suffering, and legal fees if you are sued because of injuries you caused to other people in an accident. For example, if you rear-end another car and the driver or passengers get hurt, your bodily injury liability helps cover their hospital bills and other costs. - Property Damage Liability

This covers the cost of repairing or replacing another person’s property damaged in an accident for which you are at fault. This typically includes other vehicles but can also cover fences, buildings, or street signs that you might damage. For example, if you accidentally crash into a neighbor’s fence, property damage liability will help cover repair costs.

Why it’s important:

Liability coverage protects your financial assets by covering costs related to injuries and damages to others. Without it, you could be held personally responsible for costly medical bills and repairs.

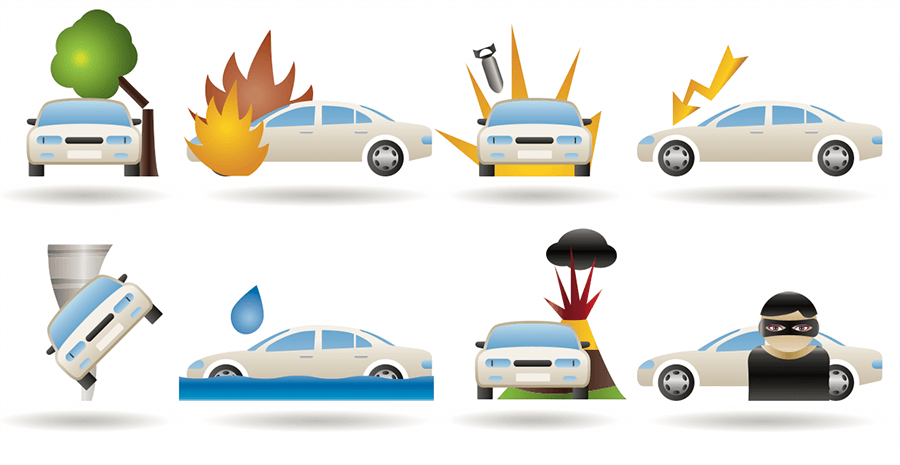

Collision Coverage

Collision insurance covers damage to your own vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. This includes accidents like hitting another car, colliding with a tree or guardrail, or rolling your vehicle.

- When is it necessary?

Collision coverage is usually optional but often required by lenders or leasing companies if your vehicle is financed. It ensures that repairs or replacement of your vehicle are covered after an accident. - Example:

If you hit a pole or are involved in a crash where you’re at fault, collision coverage helps pay for repairing your car or replacing it if it’s totaled.

Why it’s important:

It protects your own vehicle from damage costs that could be expensive, especially for newer or valuable cars.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages caused by events other than collisions. It covers a wide range of scenarios including theft, vandalism, natural disasters, fire, falling objects, and animal strikes.

- What does it cover?

- Theft or attempted theft of your vehicle.

- Vandalism such as key scratches or broken windows.

- Damage caused by weather-related events like hailstorms, floods, or windstorms.

- Fire damage.

- Collisions with animals, such as hitting a deer.

- When is it necessary?

Like collision, comprehensive coverage is optional but usually required by lenders or lessors. - Example:

If a tree branch falls on your parked car during a storm, or if your car is stolen, comprehensive coverage helps cover the repair or replacement costs.

Why it’s important:

It protects your vehicle from risks that are beyond your control and can cause significant damage or loss.

Personal Injury Protection (PIP) or Medical Payments Coverage

These coverages focus on medical expenses for you and your passengers, regardless of who caused the accident.

- Personal Injury Protection (PIP)

Required in some states (often called “no-fault” states), PIP covers medical bills, lost wages, rehabilitation costs, and sometimes funeral expenses after an accident. It typically covers injuries to you and your passengers no matter who was at fault. - Medical Payments Coverage (MedPay)

MedPay is similar to PIP but generally more limited. It covers medical expenses for you and your passengers but often doesn’t cover lost wages or other benefits. It is optional in most states. - Example:

If you or your passengers are injured in a car accident, PIP or MedPay can help pay for hospital visits, surgeries, or therapy without waiting for fault to be determined.

Why it’s important:

These coverages help you avoid out-of-pocket medical costs and provide faster access to care after an accident.

Uninsured and Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident where the other driver is at fault but doesn’t have enough insurance (or any at all) to cover your damages.

- Uninsured Motorist Coverage (UM)

Covers your medical bills and repair costs if hit by a driver with no insurance. - Underinsured Motorist Coverage (UIM)

Applies if the at-fault driver has insurance but their limits are too low to cover your damages fully. - Example:

If someone hits your car and they don’t have insurance or not enough insurance to pay your medical bills or repair costs, UM or UIM coverage steps in to cover the gap.

Why it’s important:

Increases your protection on the road, especially since not all drivers carry adequate insurance.

Additional Coverages (Optional)

These coverages add convenience and extra protection beyond the basic requirements.

- Roadside Assistance

Provides help if your car breaks down, including towing, battery jump-starts, tire changes, or lockout service. - Rental Car Reimbursement

Pays for a rental vehicle while your car is in the shop after a covered accident. - Gap Insurance

Covers the difference between what you owe on your auto loan or lease and the actual cash value of your car if it’s totaled. This is useful if your car depreciates faster than your loan balance. - Custom Equipment Coverage

Covers aftermarket parts or modifications not included in the original vehicle value.

Why it’s important:

Optional coverages provide peace of mind and additional financial protection, especially in situations where basic coverage doesn’t fully address your needs.

Factors That Influence Your Car Insurance Fees

The cost of your car insurance is determined by a complex combination of factors that insurance companies analyze to assess your risk profile. Understanding these factors can help you make informed decisions, potentially lowering your premiums while ensuring you have the coverage you need. Below is a detailed breakdown of the main elements that influence how much you pay for car insurance.

Driver-Related Factors

Your personal profile as a driver is one of the most significant factors affecting your insurance fees. Insurers look at demographic details, driving habits, and personal circumstances to evaluate the risk you pose on the road.

Age and Gender

- Young Drivers: Drivers under 25, especially males, generally face higher premiums. This is because statistical data shows that younger drivers are more likely to be involved in accidents due to inexperience and sometimes riskier behavior.

- Gender Differences: Male drivers, particularly young men, tend to have higher rates compared to females in the same age group, reflecting the higher accident rates historically observed among males.

Driving History

- Accidents and Tickets: A clean driving record with no recent accidents, traffic violations, or claims typically leads to lower premiums. Conversely, tickets for speeding, DUIs, or reckless driving, as well as at-fault accidents, can significantly increase your insurance fees.

- Claims History: Frequent claims can signal to insurers that you are a higher risk, potentially resulting in higher costs or even policy non-renewal.

Credit Score

- Credit-Based Insurance Scores: In many states, insurers use credit scores or credit-based insurance scores to help predict your risk as a policyholder. People with better credit scores often pay lower premiums because statistically they file fewer claims. However, this practice is prohibited or restricted in some states due to privacy concerns.

Marital Status

- Married Drivers: Studies show married drivers tend to be safer and more responsible, so many insurers offer discounts or lower rates for married policyholders compared to single drivers.

Vehicle Factors

The characteristics of your vehicle itself also play a crucial role in determining your insurance premiums.

Make and Model

- Cost of Repairs and Replacement: Luxury vehicles, sports cars, and vehicles with expensive parts or specialized labor requirements cost more to repair, leading to higher premiums.

- Theft Risk: Models that are frequently stolen or targeted by thieves tend to have higher insurance costs.

- Performance: High-performance or sports cars often come with higher rates due to their speed capabilities and higher accident risk.

Age of Vehicle

- New vs. Older Vehicles: Newer cars typically have higher premiums, especially if they have comprehensive and collision coverage, because their replacement or repair costs are higher.

- Depreciation: Older cars tend to have lower premiums, but many drivers opt out of collision and comprehensive coverage on such vehicles since their value is relatively low.

Safety Features

- Safety Technology: Vehicles equipped with airbags, anti-lock brakes, anti-theft devices, lane assist, automatic emergency braking, and other safety features often qualify for discounts.

- Crash Test Ratings: Cars that perform well in crash tests tend to be cheaper to insure because they reduce the risk of severe injury to drivers and passengers.

Location Factors

Where you live and park your vehicle greatly influences your car insurance rates.

Geographic Area

- Urban vs. Rural: Urban areas tend to have higher premiums because of increased traffic congestion, higher accident frequency, greater likelihood of theft, and more instances of vandalism.

- Local Crime Rates: Neighborhoods with higher rates of car theft or vandalism usually come with higher insurance fees.

Garage Location

- Secure Parking: Keeping your vehicle in a locked garage can reduce your premiums because it lowers the risk of theft or damage.

- Street Parking: Cars parked on the street overnight are more vulnerable to accidents, vandalism, and theft, often leading to higher rates.

Usage Factors

How you use your vehicle also impacts your insurance costs.

Mileage

- Annual Driving Distance: Drivers who travel long distances annually generally face higher premiums since increased time on the road increases the likelihood of accidents.

- Low Mileage Discounts: Some insurers offer discounts to drivers who clock fewer miles because they pose less risk.

Purpose of Use

- Personal vs. Business Use: If you use your vehicle for business purposes, such as driving to client meetings or deliveries, your premiums may be higher due to increased exposure.

- Ridesharing: Participating in ridesharing services like Uber or Lyft requires special coverage and often results in higher premiums because of the increased time spent driving with passengers.

Breakdown of Fee Components

Understanding your premium requires recognizing what insurers factor into the price.

a. Base Premium

Insurers start with a base rate derived from their claims data and risk assessments for drivers like you.

b. Risk Adjustments

Adjustments are made for personal risk factors like your age, driving record, and vehicle. The higher the risk, the higher the fee.

c. Coverage Limits and Deductibles

- Higher Limits = Higher Premiums: Larger payouts from the insurer increase fees.

- Deductibles: Choosing a higher deductible lowers your premium, but increases your out-of-pocket costs when you claim.

d. Discounts and Surcharges

- Discounts: Multi-policy, good driver, safety features, and loyalty discounts lower fees.

- Surcharges: Recent claims, violations, or lapses in coverage increase fees.

e. Administrative and Regulatory Fees

Some portion of your fee goes toward administrative costs and state-mandated fees or taxes.

Optional Add-ons and Their Impact on Fees

You can choose add-ons for enhanced coverage or convenience, which will add to your fees but may save you money or hassle later:

- Roadside Assistance: Adds small fees but gives peace of mind.

- Rental Car Coverage: Helps avoid out-of-pocket rental costs during repairs.

- Gap Insurance: Valuable if you owe more than your car’s worth.

- Custom Equipment Coverage: For aftermarket parts or customizations.

How Are Car Insurance Premiums Calculated?

Car insurance premium calculation is a complex, multi-step process using actuarial data and underwriting.

Step 1: Risk Assessment

Insurers collect data about you, your vehicle, and driving habits. This can include your application, credit history, driving record, and even medical history in some cases.

Step 2: Risk Modeling

They use statistical models to estimate the likelihood you’ll file a claim and the expected cost. This involves evaluating demographic data, vehicle type, location risk, and historical claim data.

Step 3: Rate Setting

Based on this risk, insurers assign a rate for each coverage type, which is then combined to form your overall premium.

Step 4: Adjustments

Discounts, fees, and any regulatory charges are applied.

Tips to Lower Your Car Insurance Fees

| Tip | Description |

|---|---|

| Maintain a Clean Driving Record | Avoid traffic violations and accidents to prevent premium surcharges. |

| Increase Your Deductible | Opt for a higher deductible to lower your monthly premium, but ensure you can afford out-of-pocket costs. |

| Bundle Insurance Policies | Combine auto, home, or life insurance with the same company to receive multi-policy discounts. |

| Install Anti-Theft Devices | Adding alarms, GPS trackers, or immobilizers can reduce the risk of theft and lower premiums. |

| Drive Less | Qualify for low-mileage discounts by reducing annual driving distance. |

| Take a Defensive Driving Course | Complete an approved defensive driving course to get discounts in many states. |

| Shop Around and Compare Quotes Annually | Regularly compare rates from different insurers to find the best deal. |

| Maintain Good Credit | Keep a strong credit score where permitted, as it can influence premium costs. |

Also Read : What Factors Affect Life Insurance Quotes?

Conclusion

Car insurance fees are a combination of multiple coverage types, personal risk factors, vehicle details, and business-related costs. Understanding the makeup of these fees enables you to make smarter decisions about your insurance policy, balancing cost with adequate protection.

Your premium reflects both the risk you bring to the insurer and the level of coverage you desire. With knowledge and smart planning, you can find a policy that fits your budget while providing the security you need on the road.

FAQs

1. What are car insurance fees made up of?

They consist of liability, collision, comprehensive coverages, optional add-ons, risk adjustments, fees, and discounts.

2. Why does my car insurance fee increase after an accident?

Accidents raise your risk profile, prompting insurers to increase your premium to cover potential future claims.

3. Can I lower my car insurance fees without reducing coverage?

Yes, by applying discounts, increasing deductibles, or improving your driving habits.

4. Are there mandatory fees included in car insurance premiums?

Yes, some states require regulatory fees or taxes to be included in your premium.

5. How does my credit score impact my car insurance fees?

Insurers use credit scores to assess risk; a better score usually results in lower premiums.

6. Do insurance companies charge extra fees outside the premium?

Most fees are included in the premium, but some companies may have small administrative or policy fees.

7. How often do car insurance fees change?

Typically at policy renewal, but can change anytime due to claims or changes in risk.